Blog

Today, over 1,340 organizations are managing $502 billion in impact investing assets worldwide, and investor appetite for impact investing is estimated to be up to $26 trillion. With such a vibrate market and significant demands, it is crucial to have a common market standard to ensure a level playing field and reduce the risk of “impact-washing.”

Answering this market need, on the Sunny Friday afternoon of April 12, 2019, International Finance Cooperation (IFC), the private sector arm of the World Bank Group, formally launched its Impact Investing Principles: “Operating Principles for Impact Management” (the Principles). Sixty global investors, representing over $350 billion impact investing assets, proudly became the first signatories.

So, what exactly are these “Impact Investing Principles”?

- What are the Principles?

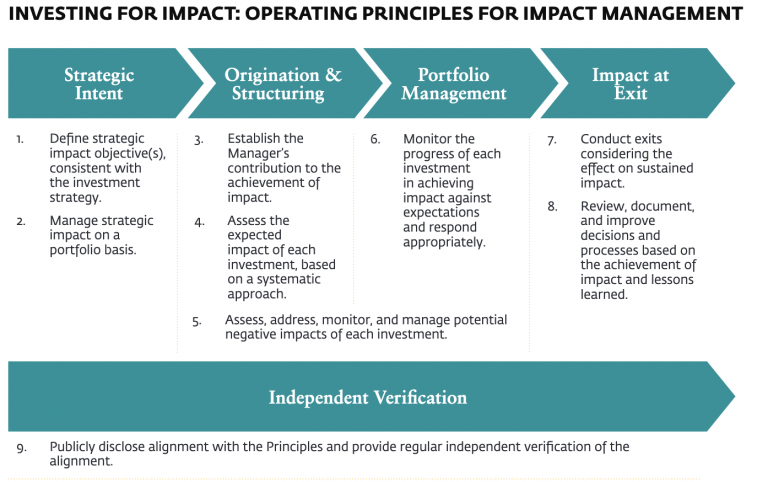

This set of nine voluntary Principles are intended to be the “market standards for impact investing,” which guides investors to strategize, structure, manage, monitor, evaluate, and report the impact of their investment, throughout the entire investment lifecycle.

The widely accepted definition of “Impact Investments” is set by the Global Impact Investing Network (GIIN) as “investments made into companies or organizations with the intent to contribute to measurable positive social or environmental impact, alongside a financial return.” Two equally essential goals characterize “impact investing”:

- positive financial return, and

- positive social or environmental impact.

Yes, financial gain is always part of the goals.

The Principles are intended to be a reference point for investors for the design and implementation of their impact management systems. They are high-level and thus give investors flexibility in execution. They are also voluntary, meaning that you can choose to comply with them or not, and you can choose to adopt them for your entire portfolio or only part of it.

The Principles follow the whole investment cycle end-to-end and cover five main elements of management activities:

- strategic intent;

- origination & structuring;

- portfolio management;

- impact at exit; and

- independent verification across all of the four elements above.

The Principles may be implemented through various systems, which are designed to be fit for different purposes and different types of institutions and funds.

For example, Principle 5 requires impact management to “assess, address, monitor, and manage the potential risks of negative effects of each investment.” The language is relatively vague, and it’s practically up to the investors or managers to decide the implementation details. You can follow the Equator Principles, the Performance Standards, the Principles for Responsible Investment, or your own internal ESG management systems, as long as they align with the Principles.

- What the Principles are not?

The Principles are not specific tools and approaches, or specific impact measurement frameworks. They do not provide detailed guidance on how each principle should be implemented or evaluated.

They are also not mandatory. On one hand, you don’t have to comply with the Principles and can choose which principle(s) that you would like to adopt for your operation. On the other hand, you can decide to become a signatory if you want to. In this case, you’re committing to following all the Principles. Although the Principles alone by themselves don’t create new legal obligations, you might choose to reflect the Principles in your internal policies and procedures, which can be binding for you.

- Who are the Principles for?

The Principles are mainly designed for:

- Asset Owners; and

- Asset Managers.

The term ‘investment’ includes, but is not limited to, equity, debt, credit enhancements, and guarantees.

Meanwhile, the guidance described in these Principles can be applied to any investment process and management, whether it’s intended to be “impact” or not.

- How to use the Principles?

You can use the Principles as general guidance in designing and implementing impact investment for any investors and asset managers. Even if impact investing is not the goal, you can still benefit from adopting all or some of them to your internal policies and procedures, as well as applying them to your investment management, because the Principles describe a way to manage investments with the intent to contribute to measurable positive social, economic, or environmental impact, alongside positive financial returns.

Furthermore, you may publicly adopt the Principles by becoming a signatory to the Principles.

This can be done at the institutional, fund or investment vehicle level. So, in theory, if you have a specialized fund that is dedicated to impact investing, you can adopt the Principles only for such funds, without committing your entire firm. The act of signing will send a strong signal to the market of your resolution and commitment to manage investments for impact and maintain a robust management system.

- What does it mean to be a Signatory?

Being a signatory is a commitment to follow and implement the Principles voluntarily and disclose the progress publicly, which sets the signatories apart and enables them to brand themselves and their products as aligned with the Principles.

- incorporate the Principle into their business processes and the selection and management its investment;

- Every year, publicly report:

- its commitment to the Principles,

- how its impact management systems are aligned with the Principles, and

- the total amount of assets that are managed in alignment with the Principles; and

- pay a nominal fee based on the asset under management (AUM).

So, this is the IFC’s new Impact Investing Principles “Operating Principles for Impact Management” in a nutshell. Please feel free to connect with me at LinkedIn if you have any questions or comments.